Introduction

India’s financial landscape is undergoing one of the most profound transformations of our times. At the heart of this shift lies the rise of fintech (financial technology) and digital payments: innovations that are redefining how money is moved, managed, borrowed, invested, and saved. For a country of India’s size—with more than 1.4 billion people, rapidly growing internet and smartphone penetration, and a large under-banked population—this isn’t just a sectoral change; it is a fundamental re-wiring of the economy.

The Context: Why FinTech and Digital Payments Matter

India’s traditional banking and payments infrastructure has long been characterised by a high cash-usage economy, many people outside full banking reach, and legacy systems that were slow to adapt. Over the past decade, cheap smartphones, better connectivity, government policy push for digital inclusion, and fintech entrepreneurship have created fertile terrain for a fintech boom.

Digital payments reduce friction in transactions, improve traceability, lower costs, and enable millions of previously unserved consumers to participate in financial flows. They are not simply replacing cash—they are enabling new behaviours, business models, and access to credit, savings, insurance, and investment products.

Market Size

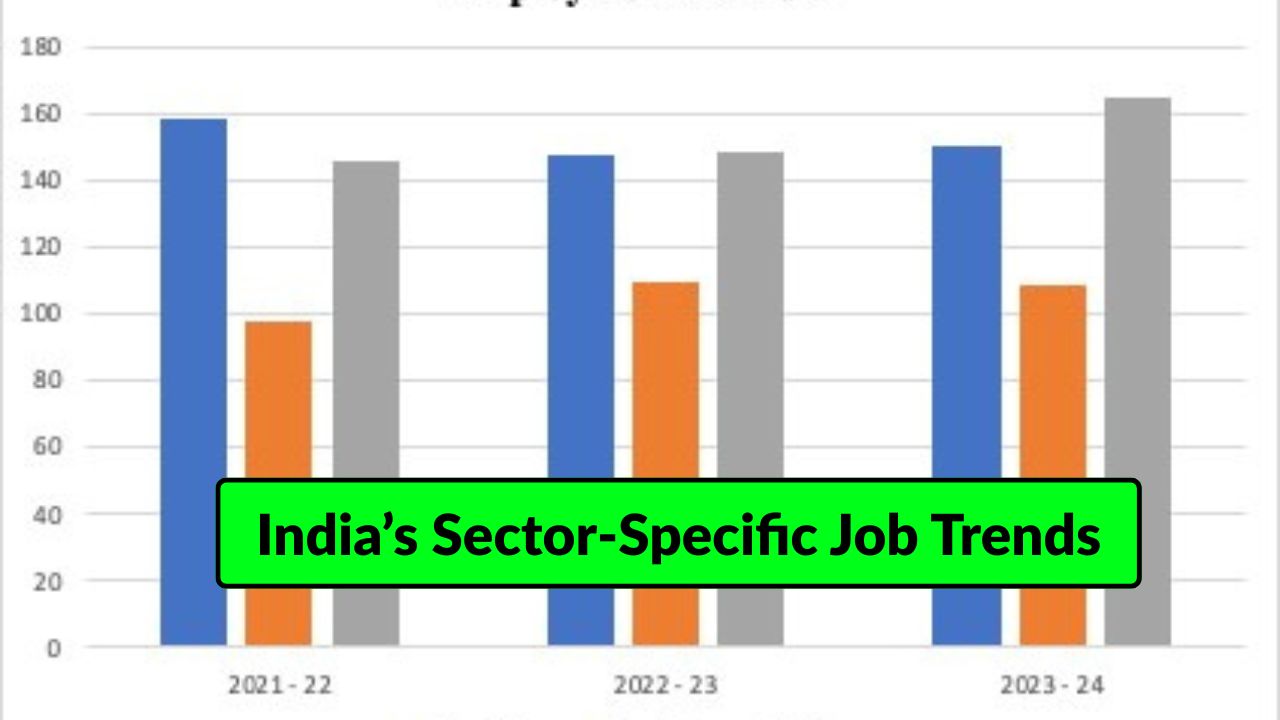

The fintech market in India is estimated to be worth around USD 689 billion in 2023 and expected to reach USD 2.1 trillion by 2030. In terms of digital payments, India’s Payments Tech sector was valued at around INR 29 trillion in FY24. Retail digital payments grew roughly 100-fold in 12 years, going from around 162 crore transactions in FY2012-13 to over 16,416 crore in FY2023-24.

Fintech adoption among consumers is estimated at 87%, well above the global average of 64%. This signals that India is a major global frontier for fintech and digital payments.

Key Drivers of Growth

- Smartphone & internet penetration: Cheap data and devices put millions online.

- Digital Public Infrastructure (DPI): Systems like UPI, Aadhaar, and DigiLocker provide foundational rails for transactions.

- Government policy & regulation: Push for financial inclusion and a less-cash economy.

- Merchant acceptance: QR codes, mobile POS devices, and UPI adoption expand access.

- Fintech innovation & competition: Startups and neobanks introduce new services and pressure traditional banks.

- Financial inclusion: Large underbanked populations create high potential growth.

Key Segments within FinTech & Payments

- Payments & PayTech: Real-time payments, wallets, merchant acceptance, UPI & QR.

- LendingTech: Digital credit, SME lending, consumer loans, alternative risk scoring.

- Neobanking: Mobile-first banking services targeting underserved segments.

- InsurTech / WealthTech / RegTech: Insurance distribution, investment apps, compliance tech.

- Embedded finance: Fintech services embedded into non-financial platforms.

Impact & Opportunities

Fintech and digital payments in India are enabling:

- Financial inclusion: Millions now have access to formal financial services.

- Economic efficiency: Reduced cash reliance, increased transparency, lower transaction costs.

- New business models & jobs: Entrepreneurs and SMEs benefit from easier transactions and access to credit.

- Unlocking MSMEs and commerce: Access to credit, payments, and digital infrastructure helps small businesses grow.

- Data-driven services: Digital payment trails enable better customer insights and personalised services.

Challenges & Bottlenecks

- Cybersecurity & fraud: Risks increase with scale of digital transactions.

- Digital divide: Rural and low-income groups may lag in adoption.

- Cash inertia: Cash remains preferred in informal sectors and rural areas.

- Merchant infrastructure: Connectivity, power, and training gaps exist.

- Regulatory complexity: Compliance with licensing, KYC/AML, and data privacy rules.

- Profitability: Low-margin payments require diversified revenue streams.

- Interoperability: Fragmentation among wallets, banks, and apps can hinder seamless integration.

- Predatory lending risk: Rapid credit growth can lead to over-indebtedness if not regulated.

Recent Trends & Emerging Themes

- Expansion of UPI and broader payment infrastructure

- Embedded finance and ecosystem integration

- Digital lending and credit via alternative data

- Neobanks targeting gig workers and freelancers

- Super-apps providing one-stop financial services

- Focus on trust, regulation, and security

- Cross-border payments and remittances

- Financial inclusion in tier-2/3 and rural regions

Future Outlook

- Massive growth potential remains for new users and services.

- Payments may become embedded and invisible within apps.

- Platforms will evolve into full financial service ecosystems.

- Focus on rural and underserved populations will drive the next growth wave.

- Regulation and digital infrastructure will be key for trust and scale.

- Global adoption of India’s Digital Public Infrastructure and UPI model.

- Fintechs will innovate around profitability, blockchain, and CBDCs.

Conclusion

Fintech and digital payments in India represent a foundational shift towards a more inclusive, efficient, transparent, and digital economy. Millions of Indians now access financial services via mobile phones, and businesses benefit from easier payments and access to credit. Despite challenges such as security, regulatory oversight, and digital literacy, India has become a global leader in fintech innovation. The next phase will focus on rural adoption, embedded finance, and sustainable business models, paving the way for a truly digital financial ecosystem for billions.